The Prediction Wars Are Coming

Prediction markets are blurring the lines between investing and gambling. Everyone wants to discuss what these innovative platforms are intent on becoming.

But nobody seems to understand what prediction markets are not.

The industry leaders - Polymarket and Kalshi - have established themselves as extremely well-funded, forward-thinking companies.

The founding teams of both are highly impressive individuals who are on the cutting edge of this field. They've kicked off a rivalry after Polymarket CEO Shayne Coplan said on CNBC that the difference between Kalshi and Polymarket is, "Polymarket is Polymarket and they're a Polymarket copycat."

Prediction markets have been around for several years but truly took center stage in regulated gambling circles around the 2024 presidential election.

Most of the time, the headlines and scoops center around a central theme — prediction markets are encroaching on regulated sports wagering platforms.

This feels undeniable on the surface. Kalshi's introduction of single-game event contracts as CFTC-approved markets sent shockwaves through the gaming world.

While they weren't the first (shout out Crypto.com's Super Bowl winner markets), they have been the loudest, and they have pressed the issue hard.

Polymarket has had individual games listed for years, offering their product outside the US (although a VPN will do) and thus air-gapped from the CFTC. They also have history together.

But everything changed in July when Polymarket announced both a fresh $200M funding round at a $1B valuation and an acquisition of a DCM-approved derivatives contract platform QCX. This acquisition paves the way for Polymarket's return to the US market, and they are ready for war.

The regulatory alleyways that Kalshi has paved over 5 years to offer their current product are about to have a truck driven through them by Coplan and his Polymarket team.

And thus, the Prediction Wars will begin.

Prediction Parlays?

But as we sit on the precipice of an entirely new real money gaming category, it's time to discuss what these platforms are not.

Despite their best efforts, and their political angling to influence their own regulators, Kalshi and Polymarket will still have to play by some set of rules. Those rules are not established by underfunded state gaming commissions — but by federal laws.

Now, federal law doesn't sound as scary as it did a couple of presidents ago, but it still holds weight.

And while they may be successful in shoehorning individual games as event contracts and spread betting as derivative contracts, there will be a line drawn in the sand.

What will that line be?

My personal wager — and I'd take it at whatever odds — is that these companies know they cannot offer the sportsbook's most profitable, most compelling feature: the parlay.

And the second leg in this personal wager of mine would be that Kalshi, Polymarket, and others will fight with all their resources to rationalize some form of parlay product as soon as they can.

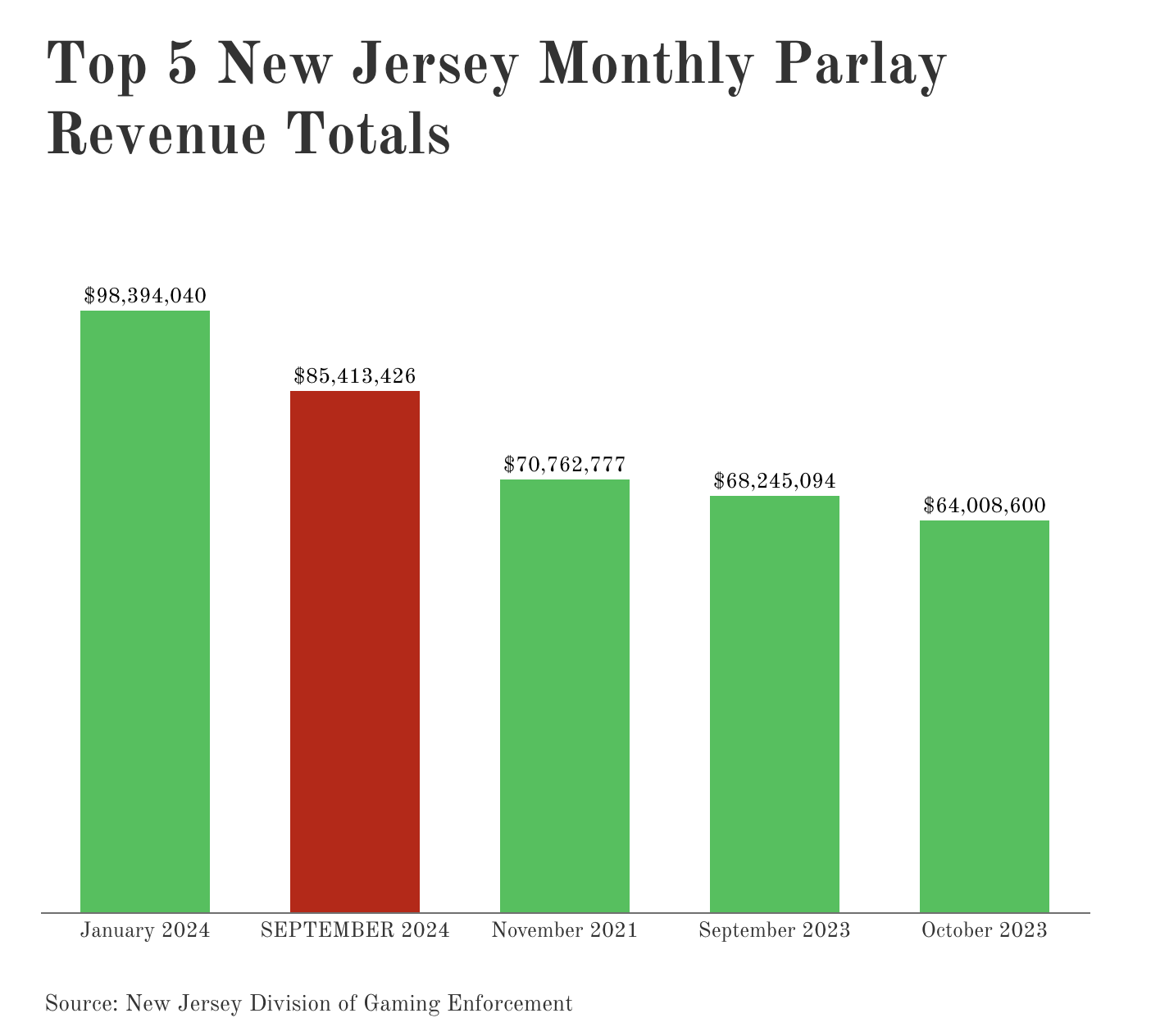

Parlays made up 71% of NJ's regulated sportsbooks' revenue at the start of last football season, posting $85M in winnings off $352M parlay wager volume (Action Network).

In short, parlays are the path to a risk-a-little, win-a-lot experience most gamblers chase. Nothing is more exciting than dreaming about hitting the six-leg parlay you just cooked up when one of your picks goes green.

Prediction markets are not made for the parlay player.

Prediction markets are made for the whales, the sharps, the traders, and in some cases, your 401(k).

I'm willing to bet there are no parlays in your 401(k).

Retention Deficit Disorder

When it comes to retention, sportsbooks know you have to spend a little to make a lot. It's not just about paying out the occasional lucky parlay — it's about creating reasons to keep coming back. Deposit matches. Injury refunds. Bonus currency. Free bets, streak rewards, profit boosts. Even $20/month subscriptions for "unlimited" parlay boosts.

Single-game bets drive volume, sure. But the profits? They come from the parlay players.

And even if/when prediction platforms can mimic many features of sportsbooks, their ability to offer retention-style rewards like profit boosts and bet refunds for injuries will always be considered too egregious by even the most favorable eyes of federal regulators.

The experience will never be the same as a sportsbook.

Peer-to-Peer... Sort of.

In some cases, these platforms may see this as at least having some perks.

For example, their peer-to-peer systems keep them from housing the risk of "customer-friendly outcomes" that books have to be on the hook for.

And while Polymarket and Kalshi will both rave about their P2P marketplaces, the way those markets work may not be what you think.

Both platforms utilize market makers, also known as liquidity providers, to fill contract entries at the time of entry.

Put simply:

When you bet $1000 USDC on China to invade Taiwan this year, there isn't someone patiently waiting on the other side to instantly take the no side of that bet at the fill price.

Kalshi works similarly, although using a less web3, more traditional Wall Street approach. Susquehanna was their first institutional market maker in April 2024.

Predictable Obstacles

Now this means that these products have two major challenges to offer parlays beyond just convincing the CFTC to approve them:

User Engagement and Liquidity.

If the CFTC approves a form of parlay wager, I think we already know how they might do it. The custom six-leg parlay you just dreamed up may not be as easy to frame as an event contract.

Alphonso Straffon theorizes a form of pre-packaged multi-leg parlays — or an RFQ mechanism that auctions off custom parlay contracts to market makers. (Straffon, 2024)

The dynamics of auction-filling parlay contracts under the pretense of a federal regulator deeming it to be in the public interest… seems ludicrous.

The language of how they operate their event contracts is being heavily litigated right now for just single-game entries themselves. But for what it's worth, the CFTC has veto power on anything it determines to be contrary to the public interest. Who sits in the decision-making chair may have a lot to do with how this plays out when tested even further.

If the regulatory problems can be solved, the market-making dynamics can probably be too. But it's going to take effectively collateralizing same-game parlays as financial instruments to get there.

So that leaves user engagement as the final challenge.

Why Prediction Markets Can't Be Sportsbooks

And thus we find ourselves at the crux of my point.

The fight to keep a player beyond a first-time deposit bonus is a battle fought by many great marketing minds across the industry on sportsbooks and fantasy sites. Even with parlays.

That is where Kalshi and Polymarket will run into a brick wall that they cannot take the screws out of. The likelihood that the CFTC approves profit boosts and cash-back free bet promotions is infinitely lower than a rationalized parlay.

These platforms are trying to be the next big innovator in sports betting in 50 states — Kalshi being the first to do so.

But they fundamentally cannot take their final sticky form in a way that can compete with the range of motion companies like DraftKings and PrizePicks have mastered. Even when their products are similar, the user experiences never will be.

The Prediction Wars are about to begin. The factions will be more than just Kalshi and a US-operating Polymarket. There will be factions from the regulated sports betting world. There will be tribes of startup challengers. In some cases, there will literally be tribes as challengers — in court.

The Real Reason I Wrote This

But perhaps the opportunity to innovate in this space is staring us in the face.

If only there was a US-based product…

with prediction market-style offerings and sports futures…

And engaging retention experiences inspired by sports betting platforms…

With a fully custom parlay builder with massive cash prize rewards up for grabs…

Well now there is.

Introducing Verse Gaming's Parlay Prediction App

Click here to see Verse's first-of-its-kind parlay prediction platform, launching September 1st.

Parlay anything. Live in 50 states*. Real cash prize payouts.

Verse has operated a real money fantasy football product for two years, and this expansion into the prediction space has been a long time coming.

If you'd like to learn more about Verse's product, reach out to me at dan@versegaming.com.