The online gaming market in the United States has been defined by groundbreaking deregulation, most prominently 2018’s repeal of PASPA, which opened the floodgates of the online sportsbooks we see today. But the hot topic in today’s gaming industry is not deregulation, but re-regulation in daily fantasy sports.

I predicted this re-regulation in a January article for Gaming Today, where I outlined the fact that between payment processors, regulators, and well funded competitors, the opportunity window for operating single player fantasy (or 'Pick Em') in the US was bound to face challenges.

So far in 2023, Maine, Alabama, Wyoming, Michigan, New York, and most controversially Florida have taken steps to prohibit single player parlay products in their states.

And just announced this week, both Colorado and North Carolina are looking at taking similar action in banning against the house parlay DFS products.

A second wave of DFS companies emerged since 2018 that offer a different way to play DFS. These companies are often referred to as DFS 2.0 for their departure from the original salary cap style DFS format. These single player games have captivated audiences across the US with a new way to play real money DFS. Despite their success, 2023 has seen a relentless push to re-regulate single player fantasy.

Click here to read more about the history of single player fantasy in my article.

Several players in the DFS space quickly rose to prominence by offering DFS-themed products labeled as Single Player Fantasy. These games pit users against the house to make over-under predictions on player statistics. The catch is that the user has to make multiple correct picks, much like a parlay. This was the first instance of DFS having an ‘against the house’ structure, and it did not take long for these operators to start acquiring users and deposits across the US.

These new age DFS products rely in part on language included in 2006’s Unlawful Internet Gambling Enforcement Act (UIGEA). This federal legislation sought to regulate the permissible uses of financial institutions operating internet gambling activities. The legislation included a carve out for games that met the traditional definition of fantasy sports at the time. The following is a quote of the language touching on the core elements of the legislation that play a role in today’s discussion.

"All winning outcomes reflect the relative knowledge and skill of the participants and are determined predominantly by accumulated statistical results of the performance of individuals (athletes in the case of sports events) in multiple real-world sporting or other events.

No winning outcome is based— (aa) on the score, point spread, or any performance or performances of any single real-world team or any combination of such teams; or (bb) solely on any single performance of an individual athlete in any single real-world sporting or other event."

Now for a single player operator, at first read of these rules, the parlay against the house product does in fact qualify under these conditions. But state regulators operate off of more than just this lone 2006 legislation, and many state commissions have applied rules and codes to their jurisdictions that deviate from federal precedent.

Single player fantasy products have operated in the United States since 2017 (and earlier), and the products have been offered in over 31 states to date. Most of these states defer to federal laws where UIGEA is the most relevant legislation in effect. The operation of these products in some markets requires licensure and approval of the state’s regulatory commission, which many of the largest single player operators have acquired in the multiple states that regulate. Some major markets like California and Texas do not have defined regulations for fantasy sports, and therefore operators conduct business in these markets for the most part unhindered.

Not all states regulate single player fantasy the same, however. Some states have made distinctions between fantasy games against the house and games utilizing the player proposition 'over-under' style. New York, for example, made a specific point to outlaw games that mimick sports betting with over under selections of projected statistics. Maine however decided that playing contests against operators (the house) are their red line. This distinction will play a key role in the coming debates around legislation.

In my January article, I particularly emphasized that OSB competitors with DFS products, like DK and FD, would begin to take action against these companies. The question was would it be subtle messages to regulators, or more explosive public condemnation.

“There are companies today posing as fantasy-sports operators, and they are running illegal sportsbooks,” said FanDuel's Head of State Government Relations Cesar Fernandez at the National Council of Legislators from Gaming States summer conference that took place in July 2023. “All we can do is highlight it. It’s really up to regulators to determine if this is something they want to do something about,” he said.

But Mr. Fernandez is not the only major gaming executive to comment on the matter. Bill Miller, the head of the American Gaming Association, echoed these sentiments nearly exactly in his State of the Industry Speech in February 2023. And just this past week, rumors emerged that suggest lobbyists representing major OSB players may have been the ones to start this spiral after reports of controversy with Wyoming Regulators.

The single player operators are not sitting idly by while this plays out. The Coalition for Fantasy Sports, which is made up of members PrizePicks, Underdog, and Sleeper, provided a comment to Legal Sports Report, which criticized the actions taken by state regulators and competitors to spur this controversy. Additionally, Underdog's General Counsel Nicholas Green published a white paper on Sept. 12th that dives into immense depth and detail on the case law of the subject and Underdog's offerings. Green is one of the most experienced lawyers in the space and the white paper lays out the exact argument being made by single player operators, so I encourage all to read it.

These providers have also taken major steps in the last 12 months to add to their government relations and legal teams, speak publicly about their positions to the media, and even challenge regulators publicly on platforms like X. Some operators have also implemented gameplay elements like injury-assurance - if a player in your pick em lineup gets injured in the game, your contest will be refunded - to reinforce that their games are skill based and not leaving unpredictable injuries to chance.

One industry expert who has covered Single Player Fantasy in depth is Dustin Gouker, writing on his Substack Closing Line:

“The states that took action aren’t changing anything. They looked at the product DFS 2.0 is offering and said, “That’s sports betting.” And while I understand the legal argument (which is pretty good!) for player prop parlays against the house as fantasy, it’s also 100% a form of sports betting.”

Underdog's White Paper disagrees, with Nicholas Green stating in his piece that "Nearly every sports wagering law passed in the United States since 2018 makes crystal clear that if a contest meets the definition of “fantasy sports,” that contest is not sports wagering. A contest is one or the other; it is legally impossible for a contest to be both."

While this battle plays out in the public eye, there is limited optimism for single player DFS as a category moving forward. Investors in the industry are showing signs of cooling off the idea that games of skill that utilize single player structures are going to be permissible moving forward in major markets.

The fight for interpretations of these laws will be done on a state by state level, leaving plenty of action ahead of us. These companies have strong claims and could turn their fate with a landmark case we cannot predict this early on. But for now, the outlook is murky and the tension is high.

DFS 3.0

DFS 1.0 spawned from FD & DK's fight to regulate peer-2-peer games of skill like salary cap fantasy. DFS 2.0 innovated by bringing a brand new game style that let players instantly play against the house.

Now, DFS 3.0 is a natural evolution of the industry to bring the beloved features from DFS 2.0 into the regulatory framework established by DFS 1.0.

A new entrant to the industry with a captivating product and future-proof legal premise could accommodate tens of thousands of DFS players who are losing access to their favorite DFS platform in states across the US. Many of these states, like Florida, already have minimal gaming options for consumers.

At Verse Fantasy, we are looking to capitalize on this evolving regulatory landscape by bringing the first DFS 3.0 product to market.

Verse Fantasy is built on the premise that innovation in fantasy gaming is possible without focusing on against-the-house parlay experiences and instead embraces the power of peer-2-peer games of skill. Verse's games are built with the modern day interpretation of state and federal laws we are seeing applied today in mind.

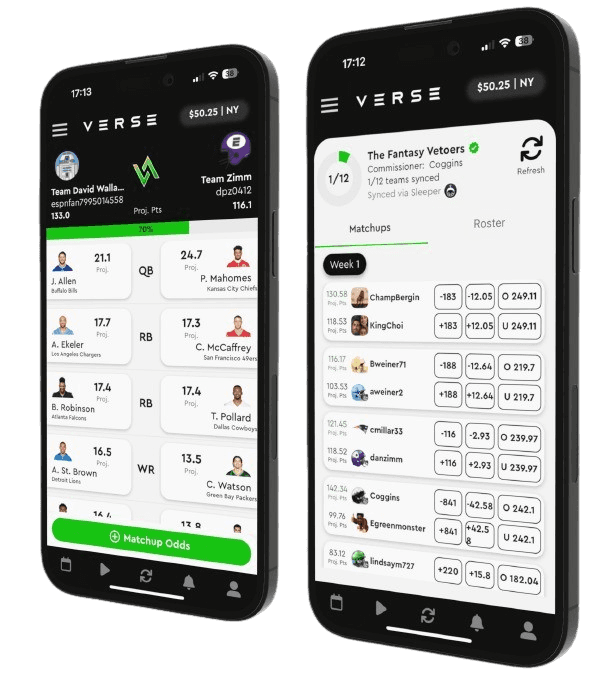

Verse’s flagship product enables users to sync their fantasy leagues from ESPN, Sleeper, and Yahoo (coming soon) into the Verse app and place real money contests on their fantasy matchups. For the first time, friends in leagues can finally play DFS games centered around the fantasy teams and leagues that drive your passion every Sunday.

With LeagueSync, you can dive into creating real money contests based on your weekly matchups in just a few taps. Players can compete on who wins the fantasy matchup, who covers the spread, or even the total points scored in the game.

These contests are entirely centered around peer-2-peer competitions and games on the activities that player’s social communities are already interested in. Anyone who has played fantasy can tell you that they are in a groupchat for the league, which instantly becomes Verse’s growth vessel.

The room for growth in monetizing the fantasy football ecosystem is massive. There are 30M fantasy football players in the US each year, spending an average of $58.50 on entry fees to season long leagues. 90% of fantasy leagues are made up of friends, family, and coworkers. The estimated prize volume of fantasy leagues last year beat out the estimated volume done on DFS platforms in total.

This is a whole new market that's been under the industry's nose the whole time (another article for this is warranted). In an industry that makes a market out of everything, I am proud that Verse is the first to bring real money markets to the most beloved way to play online fantasy games.

LeagueSync’s next iterations will support additional platforms to sync from and more ways to play.

Some of the Verse team’s favorite next iterations will be letting users play against any team in their league or any leagye on any week, so you don’t have to wait until you are matched up in the schedule to go head to head on a game.

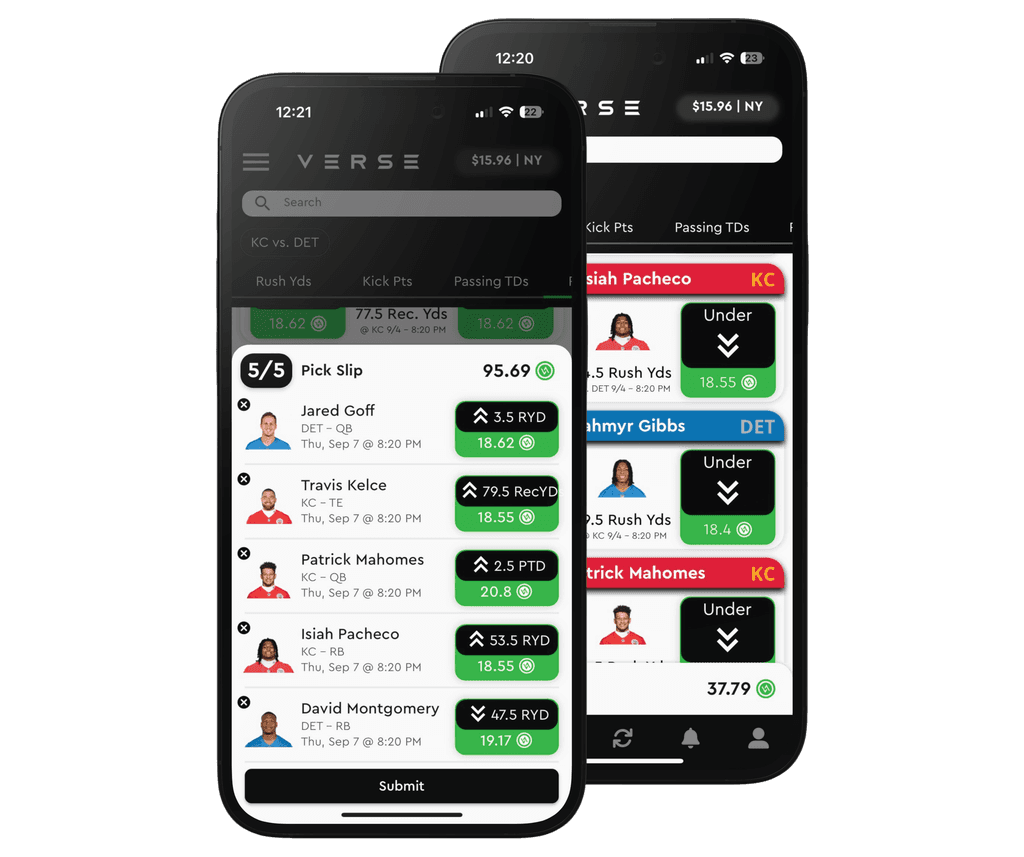

Verse hosts more than just the LeagueSync feature. Verse has remixed traditional pool style DFS into over under lineups. Pools enable players to build lineups of over-under predictions on a variety of statistical projections.

You may be asking - didn’t you start the article preaching against over under style games? That is a reasonable question - and here’s why it’s different. In Verse Fantasy pools, each prediction has a corresponding fantasy point value attached to it.

If a user gets a selection right, they are rewarded with a fantasy point total. Contests are scored by which player in the contest accumulates the most fantasy points for correct selections. There are no parlays involved, and players only have to beat each other, not the house.

This game style is impossible to script with bots like salary cap fantasy and much faster paced than the beloved Best-Ball style of DFS. Players are oftentimes choosing a lineup of predictions out of hundreds of options, not just the handful of players eligible to be drafted to their team.

What separates Verse’s pools feature is the customization and control we provide users. Users can instantly generate weekly contests for their fantasy leagues, friend groups, or work colleagues to compete in.

Players can filter which sports, positions, stat types, and games are available along with the entry fee, payout, and size of the contest. Contest creators can also brand their generated contests with their own title and image, giving influencers the ability to play against their fans for the first time ever.

Pick'Em Re-Regulation

Ushers in New Era of DFS 3.0

By Dan Zimmermann

Check out this video with Claudia Bellofatto, a sports betting analyst and host on New England Sports Network. She’s instantly able to share and compete with her 30k followers and fans in an engagement that no sportsbook can offer.

From the preliminary language used or proposed in state regulations like New York, North Carolina and Colorado, Verse’s games would qualify as permissible. Verse’s product is future-looking in this regard, and the reason why is simple. Verse Fantasy stands behind the interpretation of fantasy that FanDuel and DraftKings spent millions of dollars to develop, legislate, and ratify. As long as the pioneer products of DFS 1.0 are valid, so too will the innovative platforms in 3.0.

I have been a student of this industry from the moment PASPA was repealed and spent dozens of hours with many of the most elite lawyers in the industry. My theory that Pick Em games were at risk of reregulation long before we saw regulators take action comes from this process.

This philosophy is what gave birth to the innovation of the Verse Fantasy product. Our due diligence to determine what is and isn’t high risk led me to this theory, and the theory has inspired every inch of our product’s development. The defensibility of Verse’s position as a reimagined form of the original DFS product is apparent, and the potential is unlimited.

I truly believe that Verse Fantasy could experience similar levels of rapid success without the regulatory backlash single player operators have encountered.

Verse’s live iOS product - available here - is already catching fire amongst fantasy players, having thousands of players sign up in our first 6 weeks since launch. A majority of our sign ups come from referral codes, and 80% of our sign ups go on to sync a league into the app.

If you are captivated by what I have discussed here and think you may see the vision like our founding team, investors, and advisors do, reach out to me at Dan@versegaming.com.